Pensacola Boat Accident Lawyer

If you were injured on the water, your maritime case may need to be handled differently than a standard personal injury case. You require a boat accident lawyer with a comprehensive in maritime law. We have experience working with longshoremen, Jones Act employees, and BP claims.

Frequently Asked Questions (FAQ)

- What should I do if I am injured in a boating accident?

If you're injured in a boating accident, the first thing to do is seek medical attention, even if the injuries seem minor. Get a thorough evaluation, as some injuries may not show symptoms immediately. Report the accident to the relevant authorities and gather as much information as possible, including the other party’s contact details, boat registration number, and any witness statements. Contact an experienced boat accident lawyer to help guide you through the legal process. - How can I prove negligence in a boat accident case?

To prove negligence in a boat accident case, you'll need to establish that the other party failed to meet their duty of care, which led to the accident and your injuries. Evidence can include photos of the scene, witness testimony, boat maintenance records, weather reports, and any citations issued by authorities. An attorney can help you gather and organize the evidence to build a strong case. - Are boating accidents covered by regular auto insurance?

No, boating accidents are not typically covered by auto insurance. Boat owners usually need a separate boat insurance policy to cover accidents. This policy can include liability, property damage, and medical payments coverage. Check your insurance policy to ensure you have adequate coverage before heading out on the water. - What if the person responsible for the accident doesn’t have insurance?

If the person responsible for the accident doesn’t have insurance, you can still recover damages through your own boat insurance policy, provided it includes uninsured boater coverage. If you don’t have this coverage, you may need to file a personal injury lawsuit against the at-fault party or explore other legal avenues. - Can I file a lawsuit for injuries sustained in a boat accident?

Yes, you can file a lawsuit for injuries sustained in a boat accident if another party’s negligence caused the accident. Your lawyer can help you assess the strength of your case and guide you through the process of filing a personal injury lawsuit to seek compensation for medical bills, lost wages, pain and suffering, and other damages. - How long do I have to file a boat accident claim in Florida or Alabama?

The statute of limitations for filing a boat accident claim in Florida or Alabama is generally 4 years from the date of the accident. However, it’s important to consult with an attorney as soon as possible, as certain circumstances may shorten this time frame or impact your ability to file a claim. - Can workers on boats file for workers’ compensation if injured?

Yes, maritime workers can file for workers' compensation under laws like the Jones Act, Longshore and Harbor Workers’ Compensation Act, or other maritime-specific provisions. Depending on the type of work you do, you may be entitled to medical treatment, lost wages, and compensation for injuries sustained while working on a boat. Consult with a maritime attorney to determine your rights and options.

Need Legal Help with Maritime Claims?

Whether you’re a worker injured at sea or in a boat accident, we’re here to help. Reach out to our team for expert legal advice and support. Call tel:(850) 695-8331 now!

-

How Much Does It Cost to Hire a Personal Injury Lawyer?

The cost to hire a personal injury lawyer can vary between cases and firms. Many Personal Injury attorneys charge different amounts based on location and the firms’ history.

However, many lawyers, like the Law Office of J.J. Talbott, charge on a contingency fee basis. What this means is that there are no fees or costs to hire a personal injury lawyer unless you recover a settlement. Then, the attorney fee is based on a percentage of that settlement. In Florida, the maximum contingency fee in a personal injury case is 1/3 of the recovery, pre-suit. If a lawsuit is filed, then the fee increases to 40% of the recovery amount.

-

How Long Do I Have to File a Personal Injury Lawsuit?

In most cases, the statute of limitations requires that you file your lawsuit within two years of the date of the injury, or else you can be prohibited from recovering from the negligent party. However, this deadline may be longer or shorter depending upon a variety of factors, such as the type of negligence (medical malpractice, birth injury, product defect), the age of the victim (minor, adult), and the status of the defendant (public entity, private person).

Two years may seem like a long time, but it can pass by quickly while you are busy with the aftermath of a serious personal injury, such as concentrating on your physical recovery; dealing with insurance forms, doctor and hospital bills, and other paperwork; and getting back to work or collecting disability. If you are talking to the insurance company about a settlement, these negotiations can drag on past the deadline for you to file a lawsuit if you are not careful, which can be disastrous to your case.

Contacting an attorney soon after the accident will help ensure that the statute of limitations will not be overlooked, as well as handling other important matters such as notifying your insurance company in a timely fashion. Also, your lawyer will get started right away gathering important evidence and preparing your case for the best result either through settlement or verdict.

-

How Do I Know if I Have a Personal Injury Case?

Simply being injured in an accident does not mean that you have a personal injury case. The experienced personal injury attorneys at the Law Office of J.J. Talbott are able to tell you whether or not you have a claim.

So, How do I Know If I Have an Injury Case?

However, generally, you must be able to prove three things to establish a case:

(1) that another party was negligent,

(2) that their negligence caused your injury, and

(3) that the injury resulted in your damages.

Depending on the facts of your case, proving negligence and causation may be complex, so it is important to consult with an attorney before making any assumptions about your injury case.

Client Experiences

We Treat Our Clients Like Family

-

I really appreciated all the hard work that this law firm put in for me and how nice the people were that worked on my behalf.Dewitt L.

-

I was very pleased with the service and the recovery of my lost wages.Ann M.

-

I love you all so much. Thanks for all of your hard work! If I ever need to come back it will be you guys. Thanks.La Rheasa M.

-

Has always done it correctly and thoroughly. You can give complete trust to J.J. and the whole Talbott staff.Brian C.

What Makes Us Different?

Reasons Our Clients Love Us

-

Work Directly With Your Attorney

-

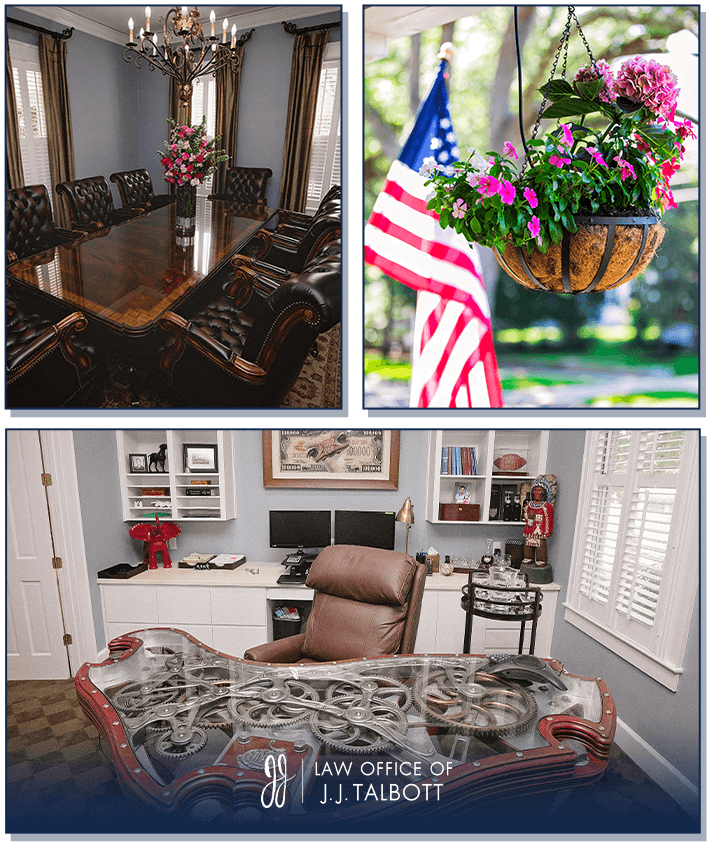

Welcoming and Laid-Back Atmosphere

-

We Always Return Phone Calls Within 24 Hours

-

We Treat Our Clients Like Family

Deepwater Horizon BP Oil Spill

The Deepwater Horizon Oil Spill accident shocked the Gulf Coast. We were concerned for our beloved beaches but also for our safety and our jobs. The cost of this oil spill is still be counted today. If you were one of the many affected by this disaster, you may be eligible for compensation. We can help you receive compensation if you:

- Aided in Clean Up

- Experienced Property Damage

- Lost Tourism Revenue

- Lost Rental Property Revenue

- Lost Income

If you need help filing or have been denied for any of the above, contact us today to find out how to get the compensation you deserve.

Continue reading to learn more about who we are and how we can help you, or contact us now at (850) 695-8331 to schedule an appointment with our team to discuss your case.